Affiliate disclosure: Ratingperson and its partners may be compensated when you purchase the products in this article.

Are you tired of searching for the best auto insurance company? Look no further! We’ve done the research and compiled a list of the top providers in the industry. Our study reveals the most reliable and customer-friendly companies, ensuring you make an informed decision that suits your needs. So, let’s dive in and find the perfect policy for you!

Best Auto Insurance Companies: Overview

While State Farm is the best overall insurance provider based on our 2022 auto insurance study, it might not be the ideal choice for everyone. Our research team has unearthed several outstanding options, each with their own unique strengths. We’ve compiled a list of the best auto insurance companies, complete with their overall scores and average annual rate estimates for full-coverage policies.

Editor’s note: The estimated rates listed in this article are based on the profile of a 35-year-old driver with good credit and a clean driving record unless otherwise noted.

Best Auto Insurance Companies: Full Reviews

In the sections below, we provide comprehensive reviews for each of the best car insurance providers. We’ve examined their offerings, financial strength, and customer satisfaction scores. By the end of each review, you’ll have all the information you need to make an educated choice. Click on the links to access our provider-specific articles for more details.

1. State Farm: Best for Most Drivers

Availability: 48 states

AM Best financial strength rating: A++

2022 J.D. Power Claims Satisfaction score: 882/1,000

In short, State Farm earned the highest score overall and is the top choice for most drivers. However, remember that individual preferences vary, and what works for one person may not work for another.

2. USAA: Best for Military Families

Availability: All 50 states, but limited to military members, veterans, and their families

AM Best financial strength rating: A++

2022 J.D. Power Claims Satisfaction score: 890/1,000

In short, USAA is the go-to option for military families. Their exceptional service and extensive coverage make them an excellent choice.

3. GEICO: Best for Coverage Discounts

Availability: All 50 states

AM Best financial strength rating: A++

2022 J.D. Power Claims Satisfaction score: 874/1,000

In short, GEICO provides the best coverage discounts in the market. If you’re looking to save money without compromising on quality, this is the company for you.

4. Liberty Mutual: Best for New Drivers

Availability: All 50 states

AM Best financial strength rating: A

2022 J.D. Power Claims Satisfaction score: 870/1,000

In short, Liberty Mutual is the ideal choice for new drivers. They offer tailored policies and extensive support to ensure a smooth driving experience.

5. Travelers: Best for Coverage Add-Ons

Availability: All 50 states

AM Best financial strength rating: A++

2022 J.D. Power Claims Satisfaction score: 854/1,000

In short, Travelers excels in offering coverage add-ons. If you value customization and additional protection, this is the company for you.

Best Car Insurance Companies: Honorable Mentions

While the previously mentioned five companies topped our study, there are other providers worth considering. These options may serve specific regions or cater to particular driver groups. Take a look at these honorable mentions and explore their offerings.

Now that we’ve delved into the best auto insurance companies, let’s explore what car insurance truly is and how much it costs.

What Is Car Insurance?

Car insurance is a necessary form of protection that covers damages caused by accidents you’re responsible for. By paying a premium, you enter into an agreement with a car insurance company to cover the expenses mentioned in your policy. While these typically include injury and property-related costs, the best car insurance providers offer additional coverage options for various potential expenses.

How Much Does Car Insurance Cost?

According to our research, the national average for a full-coverage policy is $1,730 per year or $144 per month. However, keep in mind that insurance rates are personalized for each driver, so your actual rate may differ. In the following sections, we’ll explore the average auto insurance rates across different states and the factors that influence your premiums.

Average Cost of Car Insurance by State

The state in which your car is registered plays a significant role in determining your premiums. Various state regulations and risk factors result in substantial rate differences. Check out the table below for the average yearly rates for minimum-coverage and full-coverage policies in each state.

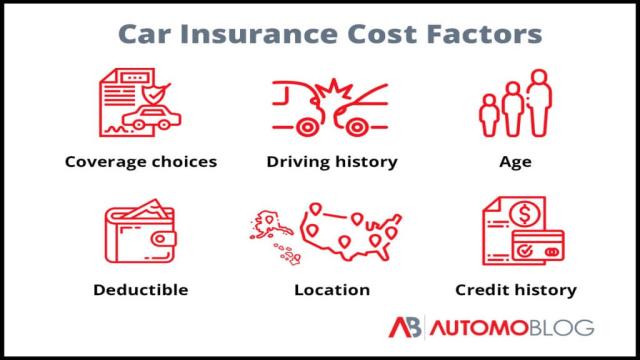

Car Insurance Cost Factors

Insurance companies consider several variables to assess your risk level and determine individual rates. The most influential factors include coverage choices, driving history, age, credit score, deductible, and location. These variables collectively influence the cost of your car insurance premium.

Car Insurance Discounts

Discounts are another crucial factor to consider when calculating your auto insurance costs. The best car insurance companies offer a wide range of driver discounts, significantly reducing your premium. These discounts help policyholders from different backgrounds and situations afford the coverage they need.

Best Car Insurance: Conclusion

State Farm received the highest overall score in our study, making it the best car insurance company. However, remember that the top choice for your neighbor may not be the perfect fit for you. Your ideal provider depends on your specific needs, driver profile, and budget. Take your time, compare multiple car insurance quotes, and evaluate each company’s strengths and weaknesses. All the providers mentioned in this article are great options to kickstart your search.

Best Car Insurance: FAQ

Here are a few frequently asked questions about the best auto insurance companies:

Our Methodology

At Ratingperson, we pride ourselves on delivering accurate and unbiased information. To determine the best car insurance providers, our expert review team considered the following rating categories:

- Affordability: We assessed auto insurance rate estimates and discount opportunities.

- Coverage: We examined the types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: We considered Better Business Bureau (BBB) ratings, financial strength, and years in business.

- Availability: We assessed state availability and eligibility requirements.

- Customer Service: We reviewed complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: We evaluated insurers based on the usability of their websites and highly rated mobile apps.

Data accurate at the time of publication.

For more information on the best auto insurance providers, visit Ratingperson.